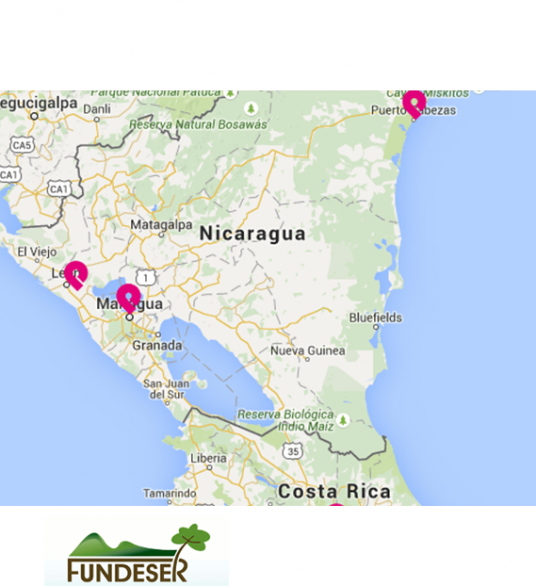

FUNDESER – Nicaragua

Founded in 1997, FUNDESER is nationally recognized for its activities in rural areas.

Currently the MFI is the third largest in the country by portfolio size (as ranked by ASOMIF). The institution has not been as badly affected by the crisis in the sector in Nicaragua in 2009 as many other institutions. The crisis, known as “NO PAGO” (‘I do not pay ‘ in Spanish), resulted from a concentration of competition and over-indebtedness, inadequate control systems in MFIs and a loosening of credit discipline. This resulted in a extreme levels of nonpayment. The IMF has managed to revive itself since then and reached operational self-sufficiency in 2011.

The institution operates in three different regions of Nicaragua and targets rural areas through a network of 21 branches. The majority of MFIs in rural areas grant larger loans than FUNDESER and thus neglect the smaller borrowers. The mission of the institution is clear: it gives equal opportunities to women and men by offering eight types of loans to its clients, trade (38.6%) and agriculture (26%) being the most important.

To enable farmers to have access to credit that allows them to purchase bio-gas systems, a collaboration agreement was signed in April 2014 between three Nicaraguan MFIs (FUNDESER, FDL and Leon 2000) and the Dutch service cooperation, the SNV.